Washington Attorney General Bob Ferguson takes capital gains tax appeal straight to the state Supreme Court OFFICE OF THE ATTORNEY GENERAL Listen Olympia Correspondent Austin Jenkins reports on the Washington […]Read More

The lawsuit by the Opportunity for All Coalition (OFAC), which successfully fought Seattle’s high-earners income tax in 2017, was filed Thursday in Douglas County Superior Court. The plaintiffs include business owners and farmers who would potentially be subject to the new tax, as well as the Washington Farm Bureau.Read More

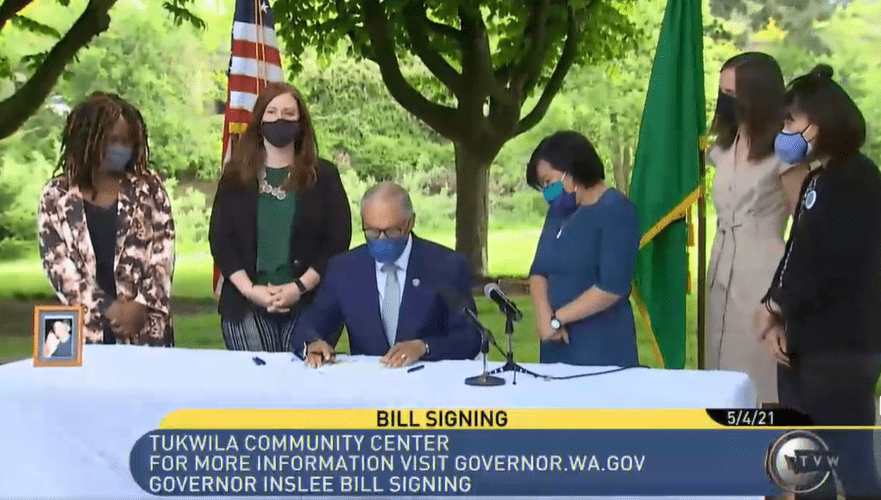

Washington Gov. Jay Inslee on Tuesday signed into law a new tax on capital gains aimed at the state’s wealthiest residents. But the future of the tax is uncertain.Read More

Just days after the Washington Legislature gave final approval to a new capital gains tax aimed at the state's wealthiest residents, the conservative Freedom Foundation has filed a lawsuit on behalf of five individuals and one couple to overturn the tax. Read More

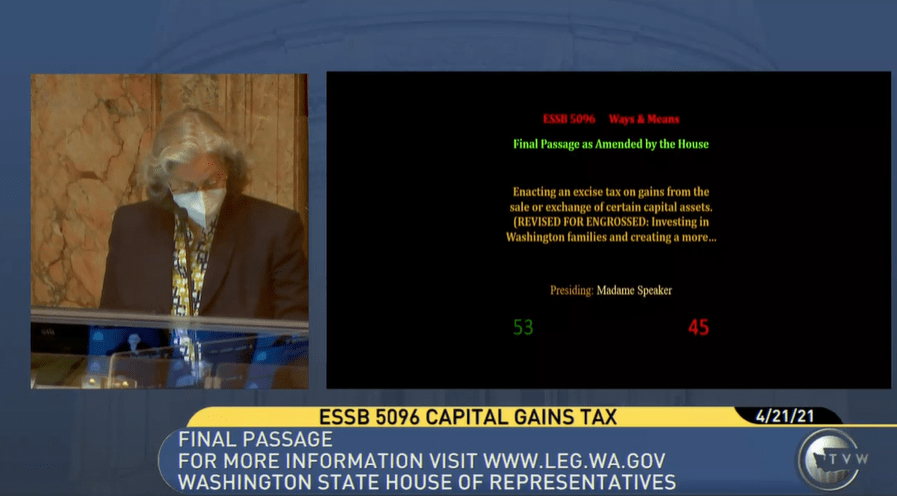

The Washington House has approved a bill to institute a seven percent tax on capital gains over $250,000 from the sale of such things as stocks and bonds. The 52 to 46 vote followed an hours-long debate that spanned two days. Read More

Profits on the sale of stocks and bonds in excess of $250,000 would be subject to a new tax on capital gains under a bill narrowly approved Saturday by the Washington Senate. The measure passed on a 25-24 vote after more than four hours of debate in the Democratic-led chamber. Three members of the Democratic caucus voted no: Sens. Annette Cleveland, Steve Hobbs and Mark Mullet.Read More

Even as the state of Washington’s revenue picture improves, majority Democrats in the Legislature appear committed to a course that will, one way or another, involve raising taxes this year. Not necessarily to balance a recession-era budget, but instead to reform a tax code they view as regressive and to address gaps and inequities exposed by the global pandemic.Read More

Each of the proposals is different. But for many Democrats, as well as others on the political left, the goal is the same: Make the richest Washingtonians pay for COVID-19 relief programs and other services that would help people who are struggling. Democrats also say the state's current tax system is highly regressive, meaning lower-income people pay a larger share of Read More

Washington state senators have teed up a mileage-based tax for electric and plug-in hybrid vehicles as the first step toward changing how the state pays for road maintenance and other transportation needs. Policymakers expect gas tax revenue to decline long term. Oregon has been experimenting with a per-mile charge for years.Read More

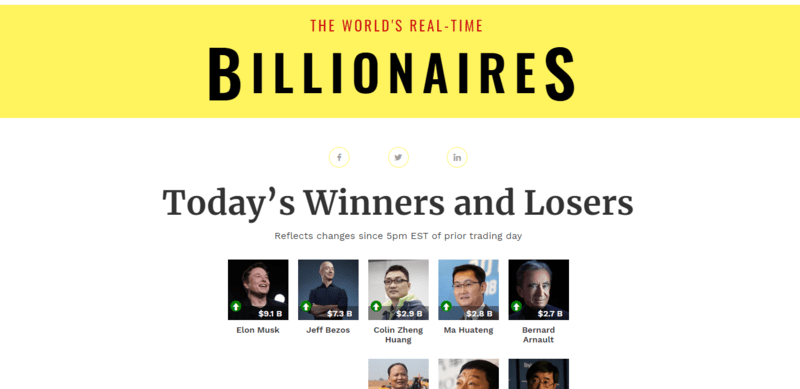

Washington billionaires would pay a “wealth tax” under a proposal in the state House that will get a public hearing on Tuesday. The bill is sponsored by Democratic state Rep. Noel Frame, who chairs the House Finance Committee, and would impose a one percent tax on intangible financial property, such as stocks and bonds, futures contracts and publicly traded options. A Read More

The tax measures are contained in the governor's two-year, $57.6 billion operating budget proposal released Thursday in advance of the 2021 Legislative session. Separately, the Democratic governor also released proposed capital construction and transportation budgets.Read More

Unlike during the Great Recession, when the budget was largely balanced through spending cuts, this time around majority Democrats and their allies, like labor unions, are already signaling that tax increases are almost certain to be part of any solution. Read More

The announcement was met with jubilant cheers from supporters at a campaign event at Yakima’s McCormick Air Center. Eyman said he initially considered running as an independent because initiatives he sponsored in the past — from $30 car-tabs to a ban on affirmative action in 1998 — were nonpartisan. Read More

On July 1, Washington stopped letting Oregon shoppers skip paying sales tax at the register, with a few exceptions. Some businesses in southwestern Washington fear the change will drive away Oregon customers who won’t want to cross the river to shop when there is no sales tax at home.Read More

Washington lawmakers adjourned at midnight Sunday after majority Democrats approved an initiative to restore affirmative action and passed a $52.4 billion, two-year state operating budget. The budget relies on an array of tax increases, including on businesses and real estate transactions, but doesn't impose a new capital gains tax as had been proposed. Read More

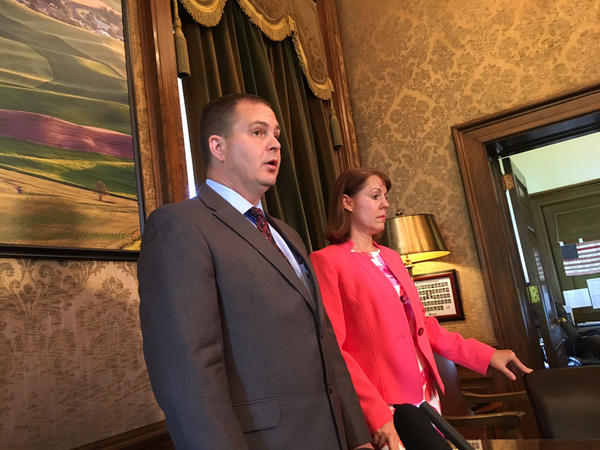

Republican state Senators John Braun and Ann Rivers speak with reporters about the compromise state budget and tax plan to fully fund schools. AUSTIN JENKINS / NORTHWEST NEWS NETWORK Listen […]Read More

The Washington Capitol in Olympia. WSDOT / FLICKR Listen After weeks of deadlock, Washington lawmakers could be close to reaching an agreement in principle on a state budget, House and […]Read More

It’s a bold move by Washington Realtors and other business groups. They’re taking on the number two Democrat in the Washington House with a TV ad that accuses him of “squeezing” taxpayers.Read More

Democrats in the Washington state House have proposed a $3 billion tax package to help fund schools and social services over the next two years. The budget and tax plan unveiled Monday includes a new tax on capital gains.Read More