Food and Drug Administration officials on Friday, Feb. 24, 2023 pledged a reset in the agency’s tobacco program, responding to criticisms that a lack of direction has hampered federal efforts […]Read More

Five-month-old Hailey plays with a rattle at her parents’ apartment in Moscow, Idaho. Her parents are taking part in Washington state’s new leave program. (Credit: Lauren Paterson / NWPB) Listen […]Read More

The Washington Supreme Court has ruled in a 7-2 decision to uphold the constitutionality of the state's new capital gains tax. The decision filed Friday comes just weeks before taxes are due.Read More

FlikrCreativeCommons James St. John Listen {RunTime 1:29} Read Pasco City Council wants to hear from the public regarding allowing Pot sales downtown. In June, Entrepreneur David Morgan asked the council […]Read More

Ben Franklin Transit Listen (Runtime 1:33) Read After 15 months of discussion the Ben Franklin Transit Board has voted to kill the talks of cutting the tax collection. The decision […]Read More

Listen (Runtime 1:19) Read Kennewick does not have a public hospital but still has a tax collecting hospital district. In 1952 after facing epidemics without having a public hospital, the […]Read More

Jaime Torres Chicano Disabled Activist Listen (Runtime 1:39) Read Residents of Benton and Franklin counties may soon have fewer transportation options.. The Ben Franklin Transit Board, or B-F-T, willl discuss […]Read More

CREDIT: Allen4names Listen (Runtime 2:41) Read Residents of Benton and Franklin counties are going to have fewer transportation options if the Ben Franklin Transit Board approves a plan to cut […]Read More

Courtesy of Community In Schools Listen (Runtime 3:20) Read A controversial tax in Benton County has raised more money than expected. Now commissioners are hearing proposals from community organizations requesting […]Read More

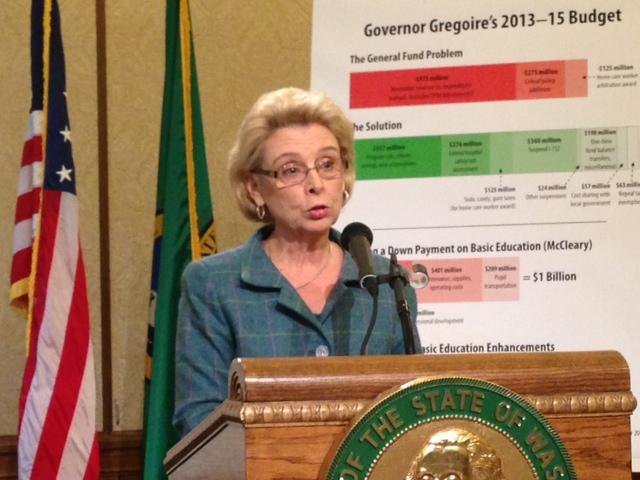

Washington’s Democratic-majority legislature approves 2-year budget plan with new spending and less tax cuts Read Listen: Olympia Correspondent Austin Jenkins reports on the budget deal. (Runtime: 59 seconds) Majority Democrats […]Read More

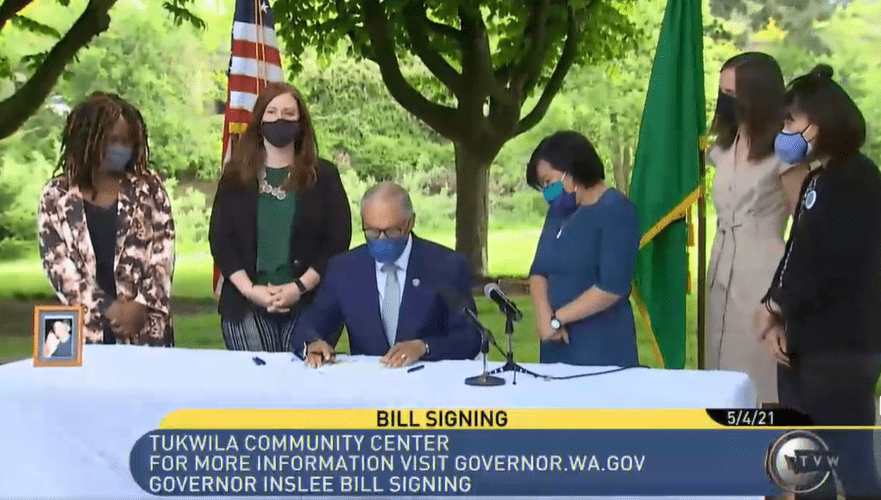

Gov. Jay Inslee on May 4, 2021, signed into law a new capital gains tax. Listen Read Washington’s attorney general says he will appeal after a judge in Douglas County […]Read More

The January 15 volcanic eruption near Tonga was a stark reminder of the threats posed by tsunamis. That's long been a concern in the Pacific Northwest, where thousands of students go to school within reach of a large tsunami.Read More

Following widespread criticisms and voter pushback, the Washington state House on Wednesday voted to delay the collection of a new payroll tax to fund a state-run, long-term care insurance program called WA Cares.Read More

Washington Gov. Jay Inslee and Democratic leaders in the Legislature announced Friday a delay in the collection of a payroll tax to pay for a new long-term care insurance benefit for workers.Read More

Franklin County Commissioners voted to raise taxes a tenth of a percent to fund mental health and drug treatment.Read More

Funds from a proposed sales and use tax in Benton County would create a facility to provide chemical dependency and mental health services. The Benton County Commissioners are holding a public hearing next week to authorize the tax. If the tax is adopted, it would collect a point 1 percent sales and use tax.Read More

The lawsuit by the Opportunity for All Coalition (OFAC), which successfully fought Seattle’s high-earners income tax in 2017, was filed Thursday in Douglas County Superior Court. The plaintiffs include business owners and farmers who would potentially be subject to the new tax, as well as the Washington Farm Bureau.Read More

Washington Gov. Jay Inslee on Tuesday signed into law a new tax on capital gains aimed at the state’s wealthiest residents. But the future of the tax is uncertain.Read More

Most Americans are eligible for free tax-preparation services, but the truly free options can be hard to find. If you’re not careful, you could end up using a service that says it’s free but demands payment after you’ve spent time entering your information.Read More

Washington’s improving fiscal picture isn’t an anomaly. A recent New York Times analysis shows that nearly half of states saw their revenues increase from April to December of last year. And many more experienced only slight declines. A key factor was federal aid that allowed even laid off workers to keep spending. Now, more federal money is headed to states from the Read More

Each of the proposals is different. But for many Democrats, as well as others on the political left, the goal is the same: Make the richest Washingtonians pay for COVID-19 relief programs and other services that would help people who are struggling. Democrats also say the state's current tax system is highly regressive, meaning lower-income people pay a larger share of Read More

A bill that increases the minimum weekly benefit for unemployed workers during the ongoing coronavirus pandemic and prevents a dramatic increase in unemployment taxes paid by businesses was signed into law Monday by Washington Gov. Jay Inslee.Read More

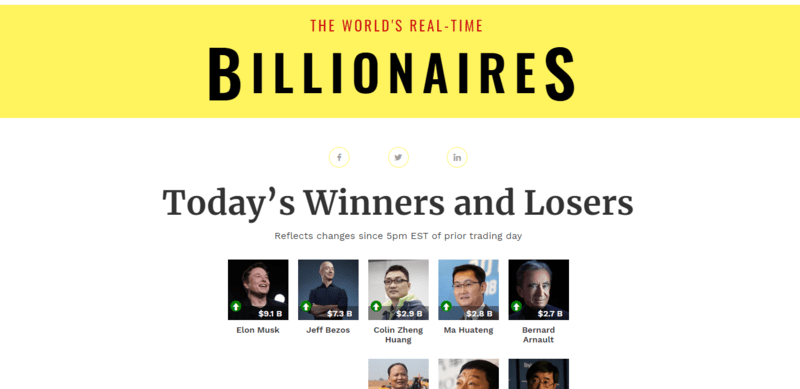

Washington billionaires would pay a “wealth tax” under a proposal in the state House that will get a public hearing on Tuesday. The bill is sponsored by Democratic state Rep. Noel Frame, who chairs the House Finance Committee, and would impose a one percent tax on intangible financial property, such as stocks and bonds, futures contracts and publicly traded options. A Read More

The tax measures are contained in the governor's two-year, $57.6 billion operating budget proposal released Thursday in advance of the 2021 Legislative session. Separately, the Democratic governor also released proposed capital construction and transportation budgets.Read More

Joe Biden's son Hunter said he learned that "the U.S. Attorney's Office in Delaware advised my legal counsel ... that they are investigating my tax affairs."Read More

There's no indication a beer tax is on tap in Olympia. But the industry isn’t taking any chances. Especially after what happened in 2010. That’s when state lawmakers imposed an increase in the beer tax as part of a plan to balance a budget hammered by the Great Recession.Read More

On Thursday, the state Supreme Court struck down Initiative 976, a measure Washington voters approved last November to reduce the cost of annual vehicle licensing fees. The measure has been on hold for nearly a year as legal challenges worked their way through the court system.Read More

President Trump paid $750 in federal income taxes in 2016 and 2017, according to the Times, which also says he's fighting an IRS audit that could cost him over $100 million.Read More

President Trump has directed the Treasury Department to stop collecting payroll taxes this fall in an effort to boost workers' paychecks. But the move is temporary, and could spark headaches in 2021.Read More

Idaho Gov. Brad Little wants the U.S. Supreme Court to stop Reclaim Idaho from gathering signatures online, as the group tries to get its education funding initiative on November’s ballot.Read More

In two 7-2 rulings written by Chief Justice John Roberts, the court allowed a subpoena in a New York criminal case but told a lower court to consider separation of powers when it comes to Congress.Read More

Unlike during the Great Recession, when the budget was largely balanced through spending cuts, this time around majority Democrats and their allies, like labor unions, are already signaling that tax increases are almost certain to be part of any solution. Read More

U.S. taxpayers will have a three-month extension to file their taxes because of the coronavirus pandemic, Treasury Secretary Steven Mnuchin said Friday. He said that at the president's direction, "we are moving Tax Day from April 15 to July 15."Read More

Washington state is on the verge of ending a large tax break for the Boeing Company and its parts suppliers. This is happening at Boeing's bidding to head off a bigger hit from threatened European tariffs.Read More

The announcement was met with jubilant cheers from supporters at a campaign event at Yakima’s McCormick Air Center. Eyman said he initially considered running as an independent because initiatives he sponsored in the past — from $30 car-tabs to a ban on affirmative action in 1998 — were nonpartisan. Read More

Democratic state Rep. Lauren Davis says Washington’s current approach to helping people with substance use disorders is like a stool that’s missing two legs. While Medicaid pays for treatment, it doesn’t fund pre-treatment services which Davis calls the first leg of the stool.Read More

Two years ago, Republicans in Congress passed a sweeping tax cut. It was supposed to be a gift-wrapped present to taxpayers and the economy. But in hindsight, it looks more like a costly lump of coal.Read More

The panel that sets highway and bridge tolls in Washington is recommending the state follow Oregon's lead and phase in a pay-by-the-mile road tax to make up for expected declines in gas tax revenue. The nonbinding recommendation to the Washington Legislature from the state Transportation Commission drew flak from skeptical taxpayers and faces a bumpy road ahead in the 2020 Read More

Thursday was supposed to be the day that a Washington state ballot measure to lower car registration fees took effect. But the state Supreme Court has let an injunction stand against what is known as the $30 car tabs initiative. That means hundreds of thousands of drivers will get full price bills in the coming months that they thought they had voted to reduce.Read More

As expected, the initiative’s passage prompted legal action, led by Seattle-area governments and public transit supporters protesting a projected $4.2 billion cut in revenue for transportation and transit projects over the next six years. But there has been an unexpected addition to that Puget Sound-centric group: the Garfield County Transportation Authority.Read More

Eyman says his decision to run is motivated in part by legal efforts to overturn Initiative 976, his car tabs measure that voters just approved.Read More

The president and his lawyers are fighting two separate legal battles to gain access to his tax records. The other involves a subpoena for the documents issued by the House of Representatives.Read More

After bemoaning that the state's highways, bridges, ferries and rail cars "are on a glide path to failure," Washington State Department of Transportation Secretary Roger Millar laid out the case for building an ultra-high speed railway on dedicated track.Read More

Sponsored by Tim Eyman, the measure would cap most taxes paid through annual vehicle registration at $30 and largely revoke the authority of state and local governments to add new taxes and fees without voter approval.Read More

Amazon’s ever-expanding footprint in Seattle — and the polarizing growing pains that accompany it — contrasts what’s currently happening in northeastern Oregon.Read More

A panel of lawmakers is examining property tax options amid complaints that taxes are going up with rising property values, while also hearing on Monday concerns from cities and counties that they’re operating on tight budgets.Read More

On July 1, Washington stopped letting Oregon shoppers skip paying sales tax at the register, with a few exceptions. Some businesses in southwestern Washington fear the change will drive away Oregon customers who won’t want to cross the river to shop when there is no sales tax at home.Read More

In this file video, the owner of a Spokane electronic cigarette store examines his display case. CREDIT: JESSICA ROBINSON / N3 Read On After years of debate, Washington Gov. Jay […]Read More

In their last minute dash to adjournment Sunday, Washington state legislators revived a lapsed sales tax break for buyers of electric cars. The resurrected incentive will be similar in value to a publicly-funded rebate for battery-powered cars that Oregon now offers. A valuable tax break for buyers of fully-electric and plug-in hybrid cars in Washington expired last May.Read More

Washington lawmakers adjourned at midnight Sunday after majority Democrats approved an initiative to restore affirmative action and passed a $52.4 billion, two-year state operating budget. The budget relies on an array of tax increases, including on businesses and real estate transactions, but doesn't impose a new capital gains tax as had been proposed. Read More