The Washington Supreme Court has ruled in a 7-2 decision to uphold the constitutionality of the state's new capital gains tax. The decision filed Friday comes just weeks before taxes are due.Read More

The lawsuit by the Opportunity for All Coalition (OFAC), which successfully fought Seattle’s high-earners income tax in 2017, was filed Thursday in Douglas County Superior Court. The plaintiffs include business owners and farmers who would potentially be subject to the new tax, as well as the Washington Farm Bureau.Read More

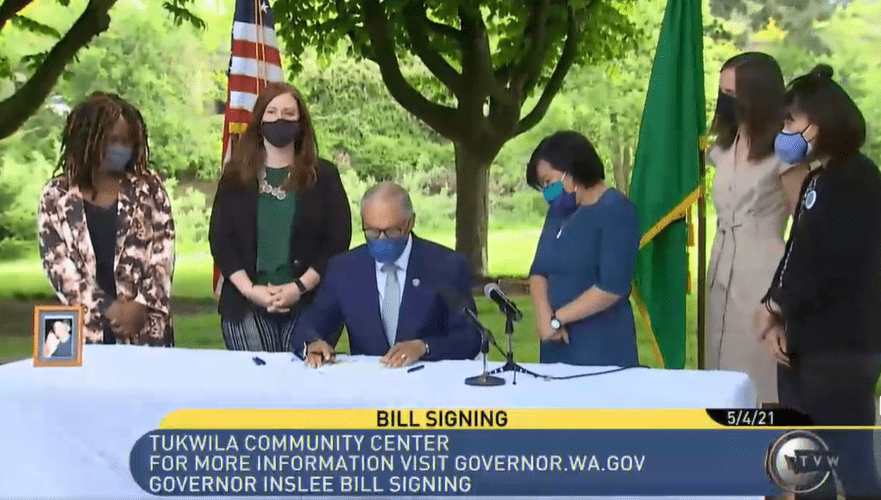

Washington Gov. Jay Inslee on Tuesday signed into law a new tax on capital gains aimed at the state’s wealthiest residents. But the future of the tax is uncertain.Read More

Just days after the Washington Legislature gave final approval to a new capital gains tax aimed at the state's wealthiest residents, the conservative Freedom Foundation has filed a lawsuit on behalf of five individuals and one couple to overturn the tax. Read More

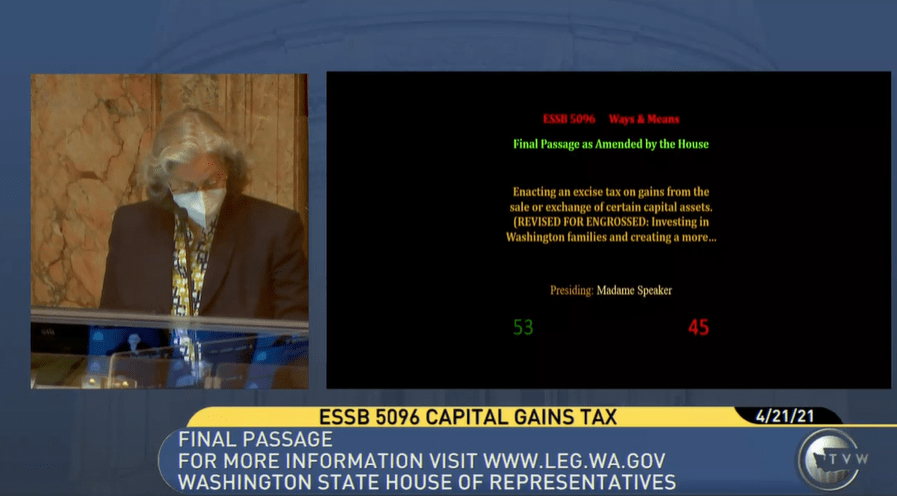

The Washington House has approved a bill to institute a seven percent tax on capital gains over $250,000 from the sale of such things as stocks and bonds. The 52 to 46 vote followed an hours-long debate that spanned two days. Read More

A new state capital gains tax. An expanded and fully funded tax credit for lower-income families. Fresh investments in disaster preparation and foundational public health. And significant new spending in early learning and child care. Those are among the elements of a proposed $59.2 billion, two-year budget Washington Senate Democrats unveiled on Thursday.Read More

Profits on the sale of stocks and bonds in excess of $250,000 would be subject to a new tax on capital gains under a bill narrowly approved Saturday by the Washington Senate. The measure passed on a 25-24 vote after more than four hours of debate in the Democratic-led chamber. Three members of the Democratic caucus voted no: Sens. Annette Cleveland, Steve Hobbs and Mark Mullet.Read More

Even as the state of Washington’s revenue picture improves, majority Democrats in the Legislature appear committed to a course that will, one way or another, involve raising taxes this year. Not necessarily to balance a recession-era budget, but instead to reform a tax code they view as regressive and to address gaps and inequities exposed by the global pandemic.Read More

Each of the proposals is different. But for many Democrats, as well as others on the political left, the goal is the same: Make the richest Washingtonians pay for COVID-19 relief programs and other services that would help people who are struggling. Democrats also say the state's current tax system is highly regressive, meaning lower-income people pay a larger share of Read More

The tax measures are contained in the governor's two-year, $57.6 billion operating budget proposal released Thursday in advance of the 2021 Legislative session. Separately, the Democratic governor also released proposed capital construction and transportation budgets.Read More

Washington Senate Democrats on Friday proposed a capital gains tax that would fund a suite of tax reductions for low-income families, small businesses and senior citizen homeowners. The tax proposal was rolled out in conjunction with the Senate Democrats' unveiling of a $52 billion two-year state spending plan, which followed a House Democratic budget presentation earlier Read More

Washington House Democrats on Monday unveiled a proposed $1.4 billion tax package, including a new capital gains tax, to fund a two-year budget with ongoing commitments to public schools, boosted spending for people with mental illness and increased reimbursement rates for a wide-range of social service providers.Read More

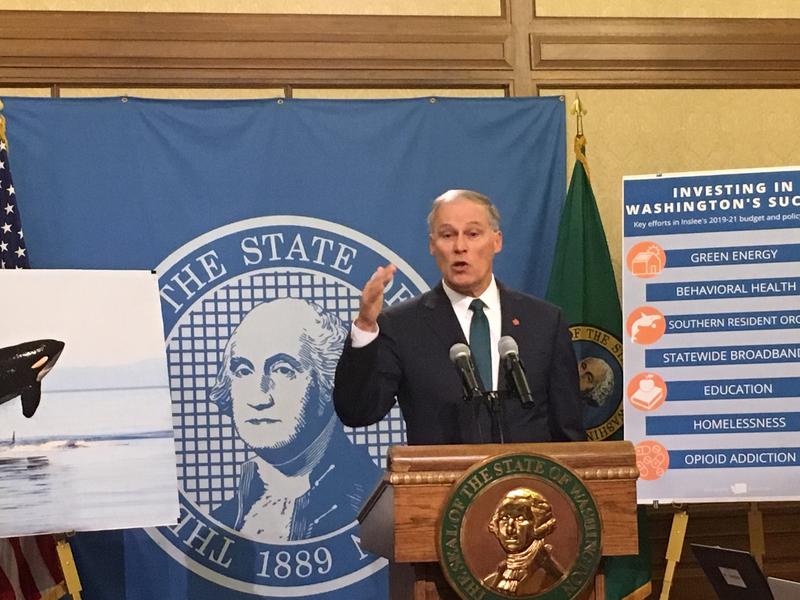

Washington Gov. Jay Inslee is proposing a hefty $10 billion increase in state spending over the next two years to maintain current services and fund new priorities, including mental health and orca recovery. To pay for it, Inslee is once again pushing for a new state capital gains tax on high income earners as well as an increase in the business and occupation tax on Read More

Democrats in the Washington state House have proposed a $3 billion tax package to help fund schools and social services over the next two years. The budget and tax plan unveiled Monday includes a new tax on capital gains.Read More