Why Bill Gates Is Investing Big Time In Farmland Across Washington And The Country

BY HANNAH WEINBERGER / CROSSCUT

Seattle’s technology billionaires are many things: innovators, visionaries, philanthropists and some less polite descriptors, depending on whom you ask. But thanks to some scrupulous digging by industry journal The Land Report, which tracks land ownership across the country, we now know that Microsoft co-founder Bill Gates has another feather in his multi hyphenated career cap: America’s Top Private Owner of Farmland.

Gates has spent years quietly diversifying his $129 billion fortune through asset manager Cascade Investments to include at least 224,000 acres of U.S. farmland since at least 2014, when the acreage was rapidly increasing in value. But a few weeks ago, The Land Report Editor Eric O’Keefe revealed Gates’ field-topping stake in cropland — as well as that he’s now the 49th largest private owner of land in the country, period.

O’Keefe unearthed this information after tracking the unnamed buyer of a conspicuously expensive single transfer of Washington acreage in 2018. The Tri-City Herald’s Wendy Culverwell reported that a farm partnership “with no clear interest in Washington” was behind the $171 million purchase of 14,500 acres in the Horse Heaven Hills area of southwest Benton County. The land is occupied by 100 Circle Farms, which produces potatoes for McDonald’s french fries.

File photo. Washington state’s richest residents, including Bill Gates and Jeff Bezos, would pay a wealth tax on certain financial assets worth more than $1 billion under a 2021 proposed bill whose sponsor says she is seeking a fair and equitable tax code. CREDIT: Elains Thompson/AP

“More often than not, farmland sales involve hundreds of acres,” O’Keefe wrote in his piece. “Thousand-acre transactions […] are blue-moon events. Tens of thousands of acres? Only sovereign wealth funds and institutional investors can [strike] a check for tracts in that league, which is exactly what occurred on the sell side of the 100 Circles transaction.”

Farmland in those parts is valuable, commanding prices between $10,000 and $15,000 per acre, far beyond the state average of about $2,000. Gates’ purchase averaged $12,000 per acre.

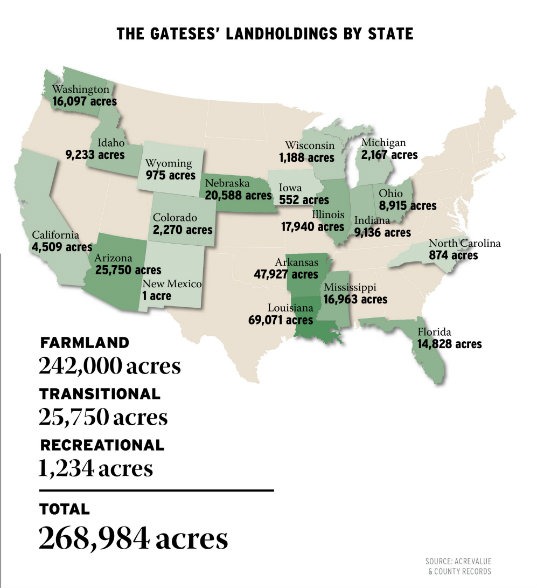

Gates’ landholdings now total 268,984 acres in 19 states. Those with the most Gates-owned land include Louisiana, Arkansa, Washington, Mississippi, Arizona, Nebraska and Illinois.

In the context of Washington state’s more than 43,279,454 acres of agricultural land, Gates’ investment doesn’t seem so impressive. But his investments in large tracts of land in prime farming areas nonetheless attract attention. Representatives from both Cascade Investments and the Bill & Melinda Gates Foundation declined to comment on his recent purchases. But people in Washington’s farming and land conservation communities express both concern and hope over what Gates’ stake in his home state means for farmers and consumers alike.

Ground investments

There are a few reasons why farmland is a strong choice for diversifying investors like Gates.

“Farmland offers an excellent means to diversify a tech-heavy portfolio,” O’Keefe told Crosscut. “It’s a sound counterbalance with proven rates of return. In addition, given the scale of Bill Gates’s investments, he has ample opportunity to build a team of superior agricultural managers, which is precisely what one sees at Gates’ farmland firm, Cottonwood Ag Management.”

“For people who are really values driven, and who want to make change with their investments, it’s a really good vehicle to do that,” says Melissa Campbell, executive director of Washington Farmland Trust.

Farmland is, of course, a valuable natural resource in dwindling supply.

“We obviously can’t make any more of it,” American Farmland Trust President and CEO John Piotti says. “It has always been a hedge against other investment instruments … [as] it can produce food, fuel and fiber, but also because of the many broader environmental services it can provide.”

All of these products become more critical as more people depend on them.

“I think intuitively we can connect that our growing population will continue to need to be able to feed itself and that farmland is a critical component, the foundation really, of our food system,” says Kate Delavan of the state’s Office of Farmland Preservation.

That Gates is choosing to invest in Washington state, O’Keefe says, is significant.

“More than anything else, the acquisition of 100 Circles in the Horse Heaven Hills says volumes about Washington’s preeminence as an agricultural powerhouse,” he says.

According to Melissa Spear, executive director of Tilth Alliance, demand for farmland is quite high in Washington state right now, with some industry analyses showing only small decreases in price during the pandemic. “We’re seeing a lot of people moving from California purchasing farmland, and I think that there’s a general sense that California is facing some real challenges” largely due to climate change, says Spear. Tilth Alliance is a nonprofit that supports organic gardening and urban ecology programs. “Washington farmland is going to be more viable as we see drought increase and weather patterns change. So farmland up here is a good investment at this point.”

Washington Farmland Trust’s Campbell, says she’s heard from both individuals and institutions through 2020 and into this year looking to invest in farmland as a means of aligning investments with their values.

Though representatives of Cascade Investments declined to comment on their strategy for Gates’ investments, O’Keefe has some preliminary ideas on why Gates is investing in the places he’s buying throughout the country.

“Based on The Land Report’s research, Bill Gates’s investments tend to be existing farmland portfolios that are subsequently marketed,” he says. “From our perspective, this means that the acquisitions are investment opportunities presented to his team that meet or exceed certain criteria. Is geographical distribution one element? That’s a possibility, but it would be pure conjecture on our part to say so.”

The hazards of consolidated farms

Gates’ purchases place him in the middle of two farming trends: The first is the building influence of nonoperator landowners, or people who don’t work the land they own. The second is his contribution to the gradual consolidation of U.S. farmland.

Campbell says there’s a clear trend over the past five years toward consolidating farmland and farm business in Washington state, especially east of the Cascades. “When we have less small farms, it tends to be less farmer owned and operated land; it tends to be a nonfarming landowner owner leasing it out to farmers,” she says.

As cropland becomes more expensive and more farmers lease land from investors, it reduces the wealth these small farmers can build for themselves, especially women and people of color. According to 2014 data from the U.S. Department of Agriculture, 38% of farmland in Washington state is rented out, with 30% rented out by nonoperator landowners. Most of these nonoperator landowners in Washington state differ from Gates in that they own a median of 406 acres, and the land has typically been in their family for more than 71 years.

“The cost of farmland is a primary concern in many of the agricultural communities across our state,” says Delavan of the Office of Farmland Preservation. “Farmland is often out of reach for beginning, limited resource or socially disadvantaged farmers.”

Additionally, American Farmland Trust has found in surveys that while nonoperator landowners do care about more than the bottom line of their investment properties, and want to be good stewards of that land, conservation practices have historically been poorer there. “We know that rented land is less likely to be managed with conservation goals in mind,” writes American Farmland Trust media relations manager Lori Sallet, in a summary of the trust’s inaugural national report on nonoperator landowners. Farmers and landowners often have difficulty communicating about long-term land stewardship, she writes, and the fact that farm leases tend to be limited to a year makes conservation investments risky for owners.

Across the country, consolidation is making farms both bigger and fewer. According to the USDA, the number of farms in Washington decreased from 38,200 to 35,600 between 2010 and 2019, while the average size of farms increased from 382 to 410 acres. Total farm acreage did not increase in that period, and Washington’s 7 percent decrease in the number of farms runs slightly higher than the national average.

The Tilth Alliance’s Spear says that while a farm’s size doesn’t prevent sustainable farming, energy-intensive techniques like no-till farming can be more difficult there, and larger farms tend to have less biodiversity. Additionally, large commodity farms like Gates’ 100 Circle Farms tend to export food out of state, or even internationally; farms owned by institutional investors tend to bypass local or regional food systems and are often removed from what’s happening in the community, Campbell says.

“When we consolidate land and farm businesses and we don’t have those small businesses who can pivot in the case of a pandemic [or profit-driven investors responsive to local community needs], that just creates some vulnerabilities in our food system, quite frankly, and that is my worry, that we’re getting further away from having a local food source, rather than closer,” Campbell says.

For local farmers, the influx of big investors draws attention. “Many of us are concerned about large-scale money coming in,” says Baird Orchard’s Jim Baird, a fourth-generation Central Washington farmer and Tilth Alliance board member. Baird has 250 acres of orchards and 1,500 acres of row cropland that he leases out and considers himself a small player. “I see it every time there’s a Midwest drought, or when there’s a California two- or three-year drought. You’ll see more money coming into the Columbia Basin because we’re probably one of the most solid areas in the country, being fed by the glaciers of Canada and the Columbia River,” he says.

Baird has seen large investment groups and pension funds making plays in the area where he grows. A few years ago, a buyer inquired about his orchard.

“I really feel… caught in a situation here between the inevitability of larger players coming into the market, and the demise of smaller farms,” Baird says. “I just don’t quite see a government regulation. I don’t see a market correction. Look at mom-and-pop grocery stores: Do they see a solution to fighting Amazon? Clearly there’s been a local food movement, the small food movement. And that’s made an impact. It has raised awareness around organics and regenerative farming.

“But … for [farmers], farmers markets and community-supported agriculture (CSAs) are a pretty small percentage. The bulk of fruit is grown, and crop commodities are grown, on large farms and they’re getting larger.”

What will Gates do with his farmland?

As of now, Gates’ intentions for his farming investments remain unknown. While declining to comment, representatives from both Cascade Investments and the Gates foundation stressed that the two organizations are entirely separate entities. The foundation maintains a focus on cultivating global partners for its sustainable farming initiatives; U.S.-based farming is largely outside of its purview. But the two organizations’ distinct approaches nevertheless fuel the suspicions and hopes of observers.

“As best as can be discerned, I believe that Bill Gates’s farmland portfolio is a long-term hold. Keep in mind that one of Bill’s closest friends is Warren Buffet, the ultimate buy-and-hold investor,” O’Keefe says.

While there’s no relationship between the Gates Foundation and Cascade Investments, Gates’ historical interest in sustainable farming and philanthropic efforts in that space through programs like Gates Ag One have some farm advocates hoping for a fusion of those things with his private investments. Cascade told The Land Report that it is “very supportive of sustainable farming.”

“I kind of have to hope that, given what an advocate the Gates family is for climate resilience and finding really interesting solutions for addressing climate change, that this undoubtedly has to be part of that thinking,” says Campbell.

If Gates chooses to keep the land in production, he could rent it out to local farmers, rather than large-scale farms that operate like 100 Circle Farms. “Leasing land is typical in many agricultural communities, particularly in parts of the state where crop rotation is critically important,” Delavan says. “Generally speaking, keeping the land in production will allow local dollars to continue to circulate within the local community which supports key farm support businesses, like tractor and equipment dealers, suppliers, or aggregation and storage facilities.”

Calls to 100 Circle Farms were not returned.

What people worry most about is the loss of farmland to development. Eleven million acres of farmland were converted away from agriculture between 2001 and 2016 in the United States, Spear says, because it’s easy to develop farmland into residential or other commercial uses, and that conversion can offer investors more money.

“What I would love to see Gates do is put a conservation easement on all the farmland he owns, which might be asking a lot, to permanently protect the agricultural value of that farmland, especially in the area that he purchased it because that is just extremely high value agricultural lands,” says Spear, who also suggests that Gates could also see higher returns on his investment by converting farms to organic ones. “But farming is a business, so there are always those [bottom-line] pressures. And are those pressures more intense if it’s an investment, like a pension fund? Probably, and that can definitely have an impact on the way the farm is run..”

No matter what size farm or who owns it, American Farmland Trust’s Piotti says keeping that land in responsible farming for the long term is critical to the nation’s future.

“We must maintain farming systems at all levels. Local, regional, national. All production regions will be challenged [by climate change], all forms, all sizes. There will be stress on the entire system,” Piotti says.

Here, Piotti raises the possibility that in his current position of power, Gates could play a major role in safeguarding that system. “It may be that the Gates’ landholdings are merely a way of diversifying their portfolio… [but] it may well be that given his commitments to sustainability in the food system, Bill Gates is amassing land to launch a large-scale regenerative agriculture initiative,” Piotti says. “In any case, I have no reason to believe that he and his representatives will not manage it responsibly.”

Visit crosscut.com/donate to support nonprofit, freely distributed, local journalism.