Washington House Passes Capital Gains Tax Following Lengthy Debate

READ ON

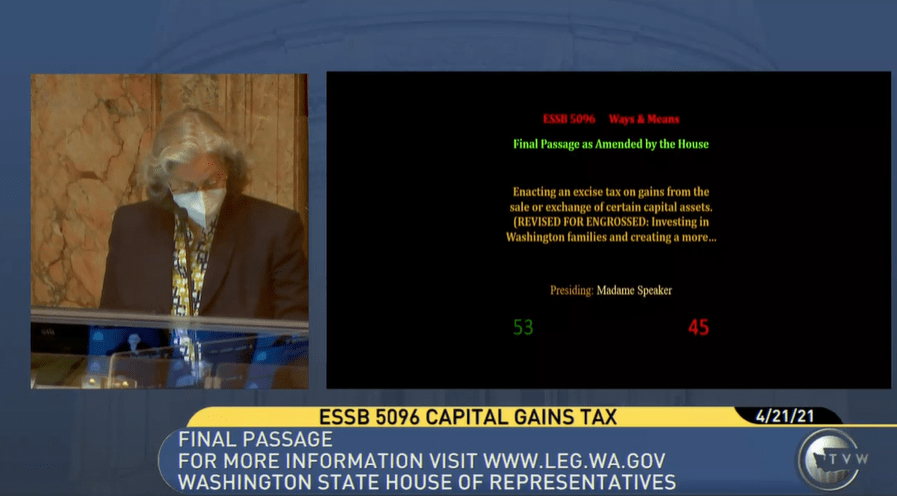

The Washington House has approved a bill to institute a seven percent tax on capital gains over $250,000 from the sale of such things as stocks and bonds.

The 52 to 46 vote followed an hours-long debate that spanned two days.

Under the measure, the tax would go into effect next January with the first payments due in April 2023. An estimated 7,000 taxpayers would pay the tax in a given year, according to a fiscal analysis of the bill. It would raise an estimated half-a-billion dollars a year.

The proceeds would go into the state’s Education Legacy Trust Account earmarked for education-related spending. Specifically, supporters say, the money would go to pay for an expansion of childcare and early learning in the state.

The bill includes a number of exemptions, including for the sale of real estate, retirement assets, small businesses and timberlands.

In arguing for passage of the measure, House Finance Chair Noel Frame, a Democrat, said a capital gains tax would make Washington’s tax code less regressive.

“Today, we are going to take another gigantic step towards justice for the working people of Washington state by finally asking the wealthiest among us to pay their fair share,” Frame said.

Frame said the tax would be paid by less than one half of one percent of Washingtonians, including some of the wealthiest individuals in the world who happen to live in Washington.

Republicans, in turn, blasted the tax as unnecessary and unconstitutional. Opponents insist it’s a form of a graduated income tax, while supporters say it’s an excise tax. If ultimately signed into law the capital gains tax would almost surely be challenged in court.

In arguing against the tax, Republican state Rep. Chris Corry warned that it could lead to a traditional income tax in Washington.

“I’m voting no on this not because I want to protect the wealthiest one percent,” Corry said. “I’m voting against this because I truly believe that this is a Trojan horse, if you will, for a graduated income tax across all Washingtonians.”

The measure previously passed the state Senate, but will now return to that chamber for consideration of changes the House made – including the restoration of language removed by the Senate that would likely inoculate the bill against an effort to overturn it at the ballot.

That language says the tax is “necessary for the support of the state government and its existing public institutions.” According to Article II of the Washington Constitution, legislation that has that language is exempt from referendum.

Asked Wednesday if the Senate will accept that change, Senate Democratic Leader Andy Billig was noncommittal, but said he agreed the funds are necessary for the function of state government.

The Legislature is scheduled to adjourn on Sunday.

*This story has been updated to reflect a new vote total following a re-vote. On the first vote a Republican House member accidentally voted yes.

Related Stories:

WA Supreme Court upholds capital gains tax just weeks ahead of collection deadline

The Washington Supreme Court has ruled in a 7-2 decision to uphold the constitutionality of the state’s new capital gains tax. The decision filed Friday comes just weeks before taxes are due.

2nd Lawsuit Filed Seeking To Overturn Washington’s New Capital Gains Tax

The lawsuit by the Opportunity for All Coalition (OFAC), which successfully fought Seattle’s high-earners income tax in 2017, was filed Thursday in Douglas County Superior Court. The plaintiffs include business owners and farmers who would potentially be subject to the new tax, as well as the Washington Farm Bureau.

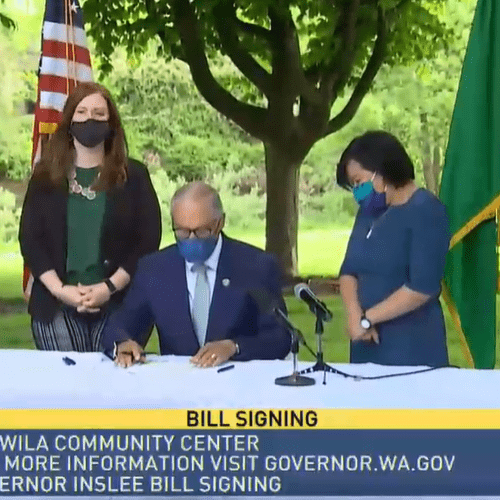

Governor Signs Washington Capital Gains Tax Into Law As Legal Challenges Loom

Washington Gov. Jay Inslee on Tuesday signed into law a new tax on capital gains aimed at the state’s wealthiest residents. But the future of the tax is uncertain.