Washington State Dems Push For Capital Gains In A Year When ‘Tax’ Doesn’t Seem Like A Bad Word

READ ON

Even as the state of Washington’s revenue picture improves, majority Democrats in the Legislature appear committed to a course that will, one way or another, involve raising taxes this year. Not necessarily to balance a recession-era budget, but instead to reform a tax code they view as regressive and to address gaps and inequities exposed by the global pandemic.

With the 105-day legislative session approaching the halfway mark, Democratic leaders are making clear that existing revenues, combined with the state’s $1.8 billion rainy day fund, plus any additional federal relief dollars the state may receive, likely won’t be enough to fund all of their priorities.

At the same time, Democrats increasingly appear to view the topic of “tax fairness” as a winning issue that is both a matter of good public policy and good politics.

This year’s tax bullishness has its roots in lasting regret among Democrats over the state’s austerity approach to the Great Recession. It’s also reflective of a tilt to the left as Democrats cement their legislative majorities and welcome a more diverse and progressive group of newly elected lawmakers into their ranks.

In turn, for the first time in recent memory, minority Republicans have felt the need to back up their standard no-new-taxes rhetoric with full-fledged budget proposals aimed at demonstrating the next state budget can spend more and still balance without new revenue.

The philosophical divide that underlies the debate is over how much the next two-year budget should spend, what those spending priorities should be and whether the state’s current tax structure is working or not.

Democrats say the system isn’t working and often point to a 2018 study by the liberal Institute on Taxation and Economic Policy (ITEP) that ranked Washington as having the most regressive tax system in the nation. The study found that the lowest 20 percent of earners in Washington spend nearly 18 percent of their income on taxes, compared to the top one percent who spend just three percent.

Advocates for change are also framing tax reform in the context of racial justice and equity — which have become top priorities for Democrats. Last month, the left-leaning Washington State Budget and Policy Center, citing ITEP data, called on state lawmakers to “tackle our racist, upside-down tax code.”

Meanwhile, Republicans, like House Minority Leader J.T. Wilcox, counter that Washington’s tax system, while not without flaws, has delivered a relatively reliable source of revenue through the current crisis.

“We have a system that actually … provides a much more predictable flow of resources to the government than any other place in the country,” Wilcox insisted recently.

Animating the conversation and debate around tax reform this year is the Democrats’ decade-long flirtation with a new state capital gains tax on the sale of such things as stocks and bonds.

The idea has been rattling around Olympia for so long that it follows a predictable path to nowhere. Democrats, including Gov. Jay Inslee, propose the tax as a progressive source of new revenue aimed at wealthy Washingtonians. Republicans and their allies attack it as a volatile and unconstitutional form of an income tax. And, in the end, it doesn’t even come up for a vote.

But 2021 could be different.

“I do feel like we have momentum this year,” said Democratic state Sen. Mona Das, who was elected in 2018. “If there’s any year that we’re going to pass it, it’s this year.”

Pressure on Democrats to finally enact a capital gains tax has been building for months. In December, Inslee once again included the tax in his budget proposal. That same month a new, union-backed political group called Invest in Washington Now launched the first in a series of ads calling for “progressive revenue solutions.”

Then, before the Legislature even convened, Democratic state Sen. June Robinson, a vice chair of the Senate Ways and Means Committee, pre-filed the governor’s capital gains tax bill.

This was an important signal. In previous years, House Democrats have led the way on the capital gains tax, and even passed it out of the Finance Committee on a couple of occasions. But it was always a tough sell in the state Senate. Without assurances that it could pass both chambers, House Democrats were understandably reluctant to take a tough tax vote on the floor only to see the idea die in the Senate.

This year, though, Senate Democrats have taken the lead on the issue indicating the political dynamics around a capital gains tax have shifted.

“In a lot of ways the Senate is driving this,” said Heather Weiner, a consultant working with the Invest in Washington Now campaign.

So what changed? For one, the political chessboard. It requires 25 votes to pass a bill in the state Senate. Democrats have 28 members. But not all of them support the capital gains tax.

Until this year, it was widely believed there were four “no” votes, making it impossible for Democrats to get the 25 votes they needed. But in November, longtime Democratic state Sen. Dean Takko of Longview — a likely “no” vote — was defeated. At the same time, Democrats gained a seat with the victory of T’wina Nobles of University Place over Republican Sen. Steve O’Ban. Nobles has said she supports the capital gains tax and is in a position to deliver the 25th vote.

“Basically there weren’t the votes to pass the tax before, but one of the ‘no’ vote Democrats got replaced with a ‘yes’ vote Democrat,” said Democratic state Sen. Mark Mullet of Issaquah, who opposes the tax. “That was a tidal wave shift.”

While many progressive voters are counting on the Legislature to pass the capital gains tax this year, Mullet argues that Democrats should instead focus on funding the state’s next transportation package.

“I think the second Democrats start passing taxes … we’re going to lose the support of the voters,” said Mullet.

But Mullet acknowleges he’s “at odds” with his caucus on this issue. And it appears the capital gains tax is on a potential fast track. The bill received a public hearing in the Ways and Means Committee during the first week of the legislative session. Then, in mid-February, an overhauled version of the bill – with a lower tax rate and a much higher earnings threshold ($250,000 instead of $25,000) before it would kick in — passed out of that committee.

“I don’t ever recall a major tax bill moving before the revenue forecast or budget release; that signals that this is an effort unto itself,” said Jason Mercier of the Washington Policy Center, a free-market think tank that actively opposes the capital gains tax.

Typically, taxes and tax votes are tied to the budget and the budget is tied to the March quarterly revenue forecast, which tells budget writers how much revenue they have to work with. At that point, if Democrats feel like there’s a gap between what the state expects to bring in and what they want to fund, they often turn to taxes.

That’s what happened in 2019 when Democrats held tax votes in the final hours of the legislative session to fund a $52.8 billion biennial budget. Notably absent from that final deal, though, was the capital gains tax.

“We held firm, I would say, on not using a capital gains tax to balance the budget,” said Sen. Christine Rolfes, the Democratic chair of the Ways and Means Committee, after the budget passed that year.

This year, Democrats are making it clear that the capital gains tax is not hitched to the normal budget process — nor is its passage contingent on how the state is faring fiscally.

“We haven’t decided exactly when it will come to the floor, but the revenue forecast is not a factor in the decision on when we’re going to run that bill,” Senate Majority Leader Andy Billig told reporters recently.

Instead, Billig extolled the capital gains tax as a way to make Washington’s tax code fairer, while also funding new priorities like early learning and affordable childcare.

“We’re 50th out of 50 states in tax fairness and I don’t think we should wait any longer than we need to to help middle class and working class families to have better tax equity in this state,” Billig said.

The sense that the capital gains tax is all but a fait accompli this year has alarmed opponents and energized Republicans.

The Washington Policy Center has launched an online ad campaign opposing the tax. One ad features the likenesses of Captain Kirk and Spock from Star Trek pondering the Democrats’ insistence that the capital gains tax is an excise tax, not an income tax.

Republicans in the Legislature also assail the capital gains tax as a form of income tax. And they’ve criticized Democrats for touting tax fairness without offering to cut taxes on lower income Washingtonians. Instead, under the amended bill, a portion of the revenues would go into an unspecified taxpayer relief fund.

“The bottom line is obvious – SB 5096 is a money grab masquerading as tax reform,” said Senate Republican Leader John Braun in a statement after the bill moved out of committee. “The people of our state don’t need that, especially at a time like this.”

Adding to Republican ire is the fact the Senate bill comes with an emergency clause, which means the tax would immediately take effect and not be subject to a voter referendum.

Some opponents have also complained that Democrats are jumping the gun on tax reform before a bipartisan work group that’s examining Washington’s tax system has a chance to finish its work.

House Finance Chair Noel Frame, who co-chairs the tax group, rejects that criticism.

“You’ve got parallel efforts that are happening at the same time, and that’s OK,” Frame said.

The capital gains tax isn’t the only tax under consideration this year. Frame has introduced a bill to impose a wealth tax on Washington billionaires.

Democrats in the Senate have also revived the idea of a tax on sugary drinks, something Washington voters rejected in 2010, with the goal of providing a permanent source of funding for public health and health equity.

Separately, Inslee has proposed to fund public health through a new assessment on individual health insurance plans.

Also in the mix is a proposal for an employer compensation tax on salaries in excess of $150,000, although a formal bill hasn’t been introduced yet.

But as Democrats prepare to write the next two-year state budget, they may find it increasingly tough to make the case for new and higher taxes.

For one, Washington is in much better fiscal shape than it was last June when the state’s revenue forecaster projected a nearly $9 billion decline in revenues, as a result of the pandemic-induced recession. That prompted Inslee to order state employee furloughs and cancel some pay raises.

Since then, the forecasts have improved considerably. As of November, the projected drop off in revenues had shrunk to $3.3 billion below pre-pandemic projections. The March forecast could potentially close much of the rest of that gap. Already, Republicans are insisting that the coming state budget is essentially balanced — even before factoring in declining demand for state services and the state’s rainy day fund.

Additionally, if Congress passes another COVID relief measure, the state of Washington could be in line to receive several billion dollars more in federal aid.

Speaker of the House Laurie Jinkins acknowledges that another round of federal money could alter the discussion around taxes. But she also cautioned that any federal dollars would be one-time money needed to address ongoing pandemic-related needs.

“You do not want to start new programs with that,” Jinkins said.

Of all the proposals, it’s the capital gains that seems to have the most buzz this year. But even if it passes, its future is uncertain. It would almost certainly face an immediate legal challenge on the question of whether it’s an excise tax or an income tax.

Despite that legal limbo, and Washington voters’ general wariness about new taxes, longtime Democratic strategist and consultant Christian Sinderman still thinks it’s a good issue for Democrats, especially this year.

“I think there’s broad agreement that the wealthy should pay a fair share,” Sinderman said, noting that economic disparities have increased during the pandemic.

According to Forbes, America’s billionaires – several of whom live in Washington — have increased their wealth by more than $1 trillion since the start of the pandemic.

A recent KING 5/Survey USA poll showed 59% support for the current proposal under consideration in the Legislature. However, a January Crosscut/Elway poll that asked about Inslee’s original proposal — with the lower income thresholds — found just 41% supported the idea.

In Sinderman’s view, Democrats can make the capital gains tax a winning issue if they focus on tax fairness and the services the revenue from a capital gains tax can buy.

“You can run for re-election on that,” Sinderman said.

Related Stories:

AG Appeals Capital Gains Tax Ruling To WA Supreme Court

Washington Attorney General Bob Ferguson takes capital gains tax appeal straight to the state Supreme Court OFFICE OF THE ATTORNEY GENERAL Listen Olympia Correspondent Austin Jenkins reports on the Washington

2nd Lawsuit Filed Seeking To Overturn Washington’s New Capital Gains Tax

The lawsuit by the Opportunity for All Coalition (OFAC), which successfully fought Seattle’s high-earners income tax in 2017, was filed Thursday in Douglas County Superior Court. The plaintiffs include business owners and farmers who would potentially be subject to the new tax, as well as the Washington Farm Bureau.

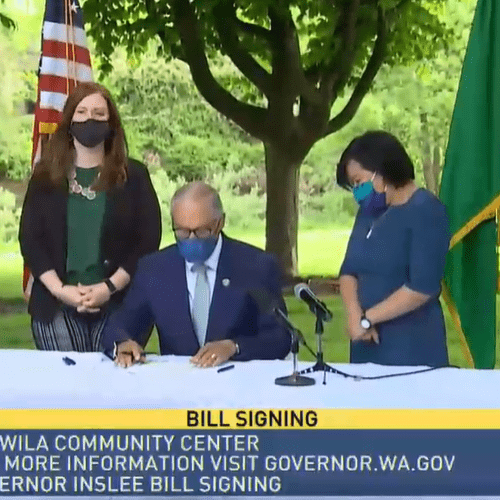

Governor Signs Washington Capital Gains Tax Into Law As Legal Challenges Loom

Washington Gov. Jay Inslee on Tuesday signed into law a new tax on capital gains aimed at the state’s wealthiest residents. But the future of the tax is uncertain.