Stock Sales By Leaders At Coronavirus Testing Company Raise Legal Concerns

LISTEN

BY TOM DREISBACH

Early on in the coronavirus pandemic, as governments scrambled to find rapid and reliable coronavirus tests, three states ended up turning to a small public company that just months earlier had no major customers and was losing millions of dollars.

The fortunes of that Salt Lake City company, Co-Diagnostics, began to rise in April when the Utah-based tech non-profit Silicon Slopes included Co-Diagnostics as part of a public-private partnership to increase that state’s testing capacity and “crush the curve.” Then Iowa and Nebraska chose to use Co-Diagnostics’ tests, too. The company’s share price skyrocketed from below $1 to around $30 at its peak, and Co-Diagnostics began bringing in millions in revenue.

Now, an NPR investigation has uncovered another side to Co-Diagnostics’ dramatic growth during the pandemic, including potential legal concerns for company leaders, and persistent questions about its tests’ accuracy.

- Two members of Co-Diagnostics’ board of directors each sold nearly $1 million worth of company stock in May, after the company’s share price had surged, but at a time when local news reports were raising concerns about whether the tests worked as well as advertised. Investors often see major stock sales by company leaders as a warning sign. So federal law requires company executives and directors to disclose stock transactions within two business days. But Co-Diagnostics’ directors did not publicly disclose some of those sales for two weeks.

- One of those directors, Richard S. Serbin, faced allegations of insurance fraud in 2006, according to public records obtained by NPR. Those allegations resulted in a six-month suspension of Serbin’s law license and a $50,000 civil penalty. The allegations have not previously been reported and were not disclosed in his official biography.

- Even as company leadership said they were confident about Co-Diagnostics’ future, in November, the company’s CEO and Chief Financial Officer both sold 100% of their direct stock holdings in the company.

- Co-Diagnostics’ claim that its coronavirus tests demonstrated “100% specificity and 100% sensitivity in several independent evaluations,” has resulted in four lawsuits from groups of investors, who allege the company misled the public. Medical experts and the U.S. Food and Drug Administration say no test is 100% accurate all of the time.

In response to NPR, Co-Diagnostics’ attorney, Ross D. Carmel, said in a statement that the legal obligation fell on “individual” (Carmel bolded and italicized the word) board members to file their disclosures on time, and that “this is not a Company obligation.” Carmel stated that oversight of board members’ disclosures is “not in the company’s purview.”

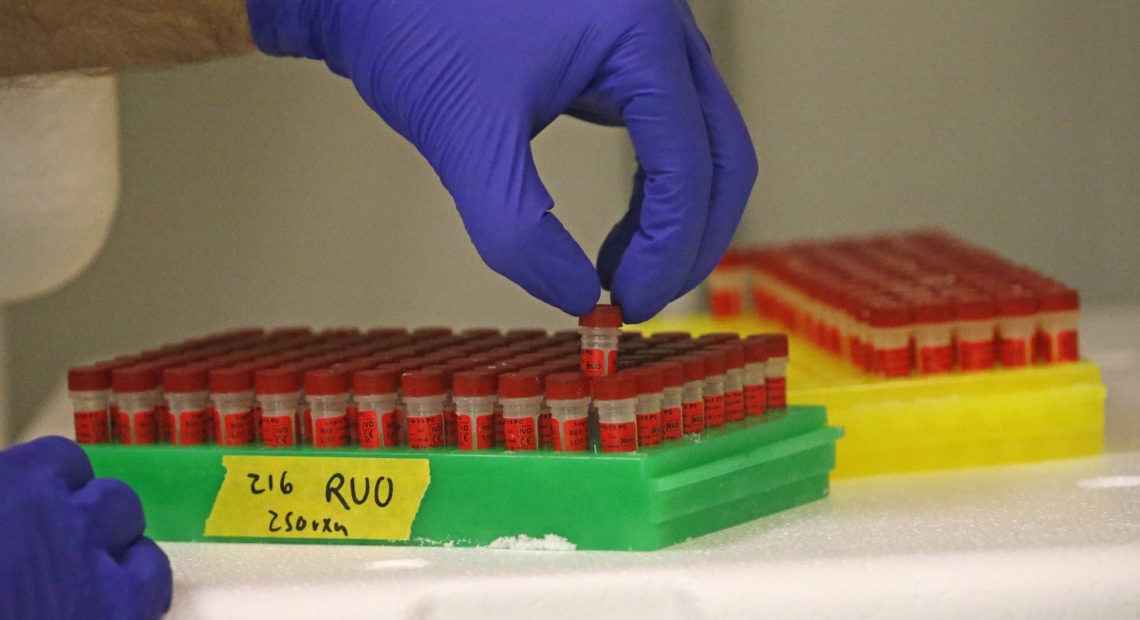

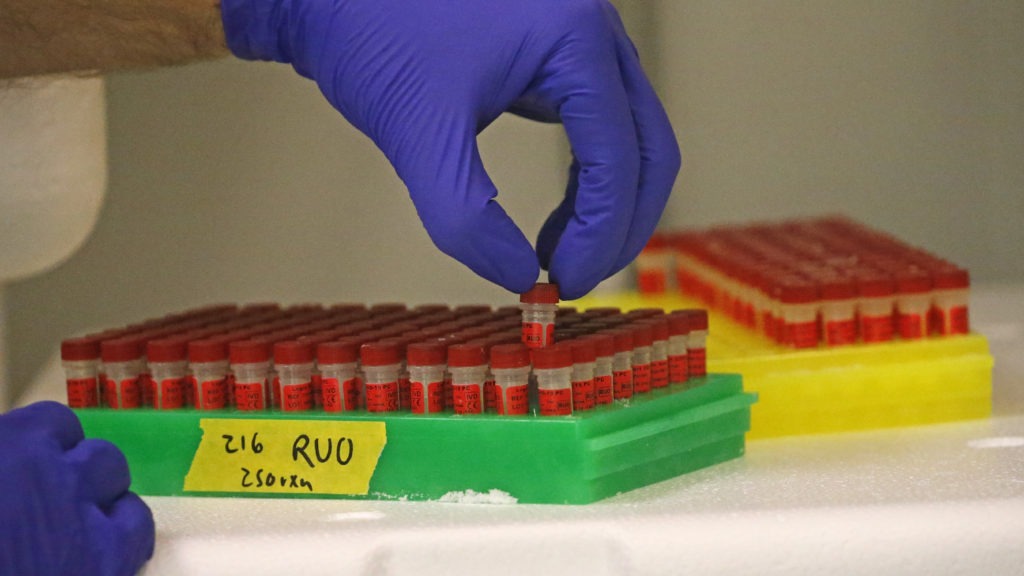

A lab technician for the company Co-Diagnostics prepares components for a coronavirus test. The company has come under scrutiny regarding its tests’ accuracy and stock sales by leadership at the company. CREDIT: Rick Bowmer/AP

“There is nothing to suggest that either Messrs. Durenard or Serbin acted with any illicit intent when selling their shares, or in regards to reporting such sales,” the statement continued. “That being said, and as required under SEC [Securities and Exchange Commission] rules, the Company will properly disclose delinquent filings made by Company insiders in its 2020 10-K and subsequent proxy statement.”

The company declined NPR’s interview requests, declined to comment regarding the allegations against Serbin, and said it would not put NPR in contact with any members of the board of directors.

NPR’s attempts to reach Durenard and Serbin independently through their previous companies and lawyers representing them in shareholder lawsuits were unsuccessful.

In response to the lawsuits alleging that Co-Diagnostics misled investors, the company has said that its claims of accuracy have been “mischaracterized,” and stated, “Co-Diagnostics stands behind the quality of our technology platform, and performance of our testing products. We intend to vigorously defend this matter.”

A spokesperson for the SEC also declined to comment.

From a penny stock to multiple states’ testing source

At the end of 2019, Co-Diagnostics’ financial reports told a story of a struggling company.

Co-Diagnostics focused on developing tests for infectious diseases like the Zika virus, HIV and tuberculosis. But at that point, the company stated, “We currently have no major customers,” and they had run losses worth millions of dollars. By the close of the markets on New Year’s Eve 2019, the company was trading for just 89 cents per share.

Then came 2020, the coronavirus pandemic, and a string of good news for Co-Diagnostics. In January, the company’s CEO, Dwight Egan, appeared on CNBC and Fox Business to discuss efforts to develop a coronavirus test. By April, the company’s test received an Emergency Use Authorization from the FDA.

Meanwhile, states were scrambling to find tests. That search led three states to Co-Diagnostics.

Utah, Nebraska and Iowa contracted with Co-Diagnostics through another Utah company, Nomi Health, which was part of the group organized through Silicon Slopes. Early on in the pandemic, Nomi’s CEO, Mark Newman, said in a public Zoom call, that “three weeks ago, none of us knew anything about lab testing.” His company partnered with Co-Diagnostics to provide the actual coronavirus tests.

The head of Silicon Slopes, Clint Betts, pledged at both a press conference with Utah’s governor and a subsequent online “town hall” that, “no one – no company will be making money off of the testing.”

But in a blog post weeks later, the organization clarified that pledge, stating that what began as a “volunteer effort” later involved “commercial terms.”

In fact, Nebraska’s annual contract with Nomi Health was worth $27 million, a spokesperson for Nebraska’s governor told NPR. The contract with the state of Iowa was $26 million. And between March and September 2020, the state of Utah paid Nomi Health nearly $10 million. It’s unclear precisely what portion of that money went to Co-Diagnostics, and Nomi Health declined to disclose that figure to NPR.

Co-Diagnostics had competition among other, more established companies selling Coronavirus tests. But after receiving its contracts with states, the company claimed to have an edge.

“In countries where we have been evaluated against other tests, we have consistently and repeatedly achieved 100% clinical sensitivity and specificity,” said Chief Science Officer Brent Satterfield in a press release on May 1, referencing two measures of testing accuracy, “and you can’t do better than that.”

Investors were flocking to the company. By mid-May, the company’s stock was trading for more than $20 per share, an increase of more than 2,000% compared to the beginning of the year.

Claims of perfect accuracy lead to intense scrutiny

The company’s statements about its test’s accuracy have now led to accusations in a civil lawsuit of “blatantly fraudulent statements.” Meanwhile, local news reports found that the Co-Diagnostics tests have shown a lower “positivity rate” – the percentage of people who take a test and receive a positive result – than other tests, raising additional concern.

Experts say a perfectly accurate test simply does not exist in the real world. Dr. H. Gilbert Welch, a scientist at Brigham and Women’s Hospital in Boston, called claims of 100% accuracy “laughable.”

“All [of] our diagnostic tests are imperfect,” Welch told NPR. “Any time someone says, ‘I make a perfect product and there’s never a problem,’ I think people should be a little skeptical.”

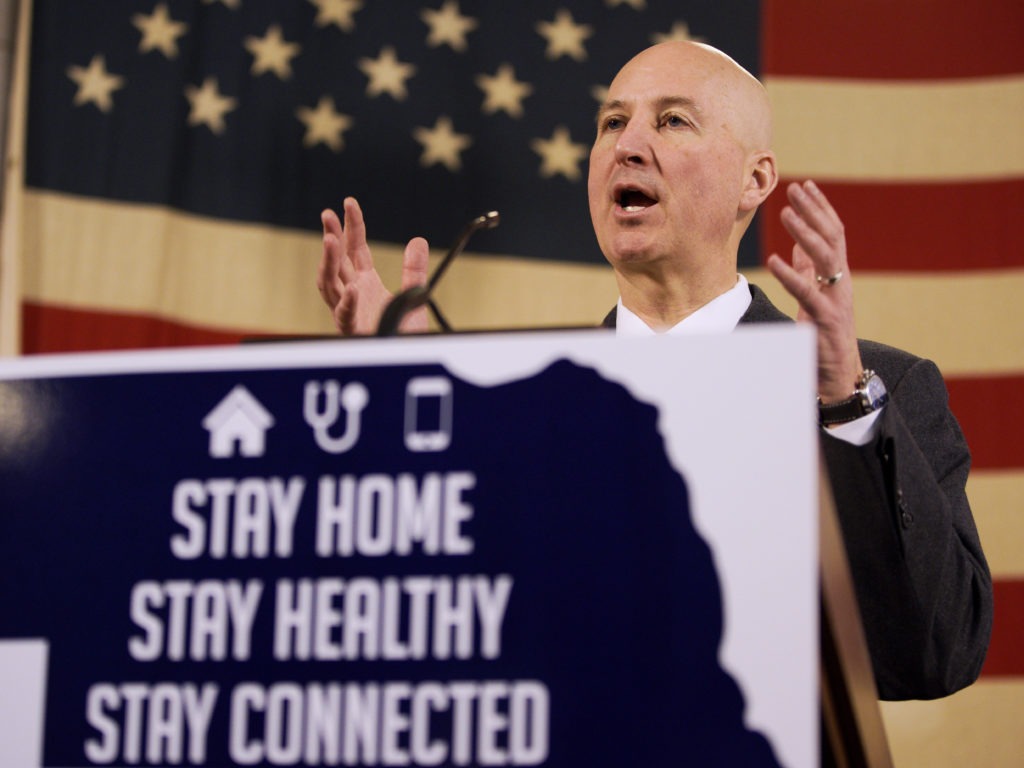

Nebraska Governor Pete Ricketts, speaks during a news conference in April. Nebraska is one of three state governments that have used coronavirus tests from the company Co-Diagnostics. CREDIT: Nati Harnik/AP

The FDA also says on its website, “No test is 100% accurate all of the time.”

States that used Co-Diagnostics’ tests also found that they did not hit that 100% benchmark.

On May 11, Nebraska’s Governor Ricketts said a lab in Nebraska had determined the test was “95 percent accurate.” Three days later, Iowa Governor Kim Reynolds announced that the tests had achieved, “high ratings of 95 percent accuracy for determining positives and 99.7 percent accuracy for determining negatives.”

Those figures may sound high, but in diseases with a relatively low prevalence in the overall population, variations in a test’s accuracy can make a big difference.

Journalists for the Salt Lake Tribune in Utah, and the Gazette in Cedar Rapids, Iowa reported concerns about the accuracy and the speed of those tests. NET, Nebraska’s public media service, reported that the Co-Diagnostics tests were returning about half of the number of positive cases as other tests, and “the concern is that the tests miss positive cases.” Local officials insisted that the variation was because a broader group of people was taking the test, including people without any symptoms.

Co-Diagnostics said it stood by the test’s accuracy.

But not everyone was persuaded, especially after the company’s share price started becoming more volatile. Investors have since filed four proposed class-action lawsuits, arguing that the company misled them about the tests’ accuracy.

“People lost millions and millions of dollars of shareholder value, and we believe that the company should be held accountable for that,” said Michael Fasano, an attorney representing one such investor.

Co-Diagnostics has argued that the company’s statements about the test accuracy were only about specific evaluations, and that it never claimed the tests were 100% accurate in all circumstances.

“Co-Diagnostics claimed nothing more than that it achieved the results as specified in the independent evaluations, a claim which is unequivocally and undeniably true,” wrote Christopher P. Milazzo, an attorney for the company.

Amid market volatility, two board members cash in

As Co-Diagnostics’ share price fluctuated, two members of the company’s board of directors – Eugene Durenard and Richard S. Serbin – cashed in their stock. And the circumstances around those trades have raised additional questions about the testing contractor.

According to his company biography, Durenard is the CEO of Hyperbolic Holdings, “a Swiss-based holding, management consulting and investment advisory company specialized in healthcare.” Serbin’s company biography states that he is a longtime consultant for healthcare companies.

Between May 19 and May 28, 2020, after questions had been raised in local media and by a prominent short-seller called Hindenburg Research, each man sold 50,000 shares in the company.

If Durenard and Serbin had sold those shares on January 2, those sales would’ve been worth less than $50,000 each. But by May, Co-Diagnostics was trading for more than $18 per share, and those sales were worth more than $900,000 each. (Today, those shares would be worth under $600,000.)

A health worker performs a coronavirus test at a Test Iowa site in Waukee, Iowa. CREDIT: Charlie Neibergall/AP

Daniel Taylor, an associate professor at the Wharton School of the University of Pennsylvania, said the federal law that requires public disclosure of these stock sales is not just a technicality.

“It’s important that shareholders and investors and other stakeholders in the company are able to monitor the trading of officers and directors to make sure that they’re acting not in their own best interests, but in the interests of the company,” said Taylor.

But Durenard and Serbin of Co-Diagnostics failed to publicly disclose their stock sales until June 5, more than two weeks after the first batch of those sales took place and long after the legally mandated deadline.

“This is an extreme outlier,” said Taylor.

In one case, according to the filings, the company also awarded Durenard stock options for 25,000 shares in June 2019. But Durenard did not disclose that until nearly a full year later.

“I think the circumstances suggest either extreme negligence, weakness of internal controls or intent,” said Taylor.

The government requires individual executives and officers, rather than companies, to disclose stock purchases and sales. But the SEC has encouraged companies to make sure the filings go out on time, and has even brought cases against publicly traded companies for allegedly “contributing to filing failures.”

Monica Loseman, an attorney with the firm Gibson Dunn who specializes in defending companies facing SEC investigations, said issues with late filings can plague small companies like Co-Diagnostics.

“It could certainly be that the company is trying to hide something from investors,” said Loseman, “but it’s just as plausible, maybe even more plausible, that the company is suffering from some growing pains at the moment.”

In fact, the company has acknowledged in multiple reports to the government that some of its internal accounting procedures “were not effective,” and could lead to errors on the company’s financial statements.

Will the SEC step in?

Even if the violations were inadvertent, the SEC can seek financial penalties against people or companies that break the laws around disclosing stock sales.

But Loseman said government investigators tend to react differently if the evidence suggests a violation was simply a mistake versus an active attempt at deception. “It all depends on the facts and circumstances,” she said.

In the case of Co-Diagnostics, the government may look closely at the fact that the board members who failed to file their disclosures on time also lead the company’s internal audit and compensation committees. Those committees are supposed to “monitor and advise” the company, to ensure it follows legal requirements and other best practices. Their positions would suggest that both Durenard and Serbin should be aware of the laws around disclosure of stock sales.

NPR also uncovered past allegations against Richard S. Serbin, which may inform the SEC’s response. In the early 2000s, the New Jersey Office of the Insurance Fraud Prosecutor investigated Serbin. After suffering a stroke, prosecutors said, Serbin said he could no longer work, and started collecting disability benefits from his insurance company. But prosecutors alleged that Serbin actually continued to work – collecting more than $170,000 in disability benefits from the insurance company, while also making nearly $200,000 in consulting fees.

Serbin pleaded guilty to a charge of falsifying records. That charge was dismissed after he paid more than $200,000 as part of a civil penalty and restitution to the insurance company. New Jersey’s Supreme Court later suspended Serbin’s law license for six months, and the state’s Board of Pharmacy found grounds to revoke his pharmacist’s license. (Records from the pharmacy board indicate Serbin voluntarily retired from practicing pharmacy, instead of facing formal disciplinary hearings.)

Co-Diagnostics declined to comment on the allegations against Serbin or how he was chosen to join the board of directors. NPR was unable to reach Serbin and Durenard independently. Lawyers representing the two men in court did not respond to NPR’s messages.

As the questions surrounding Co-Diagnostics have grown, the company’s share price has fallen from its peak, but remains much stronger than it was at the beginning of the year.

The states of Nebraska and Iowa continue to use the company’s tests. “Nebraska is very pleased with the tests provided by Co-Diagnostics,” said Taylor Gage, a spokesperson for Nebraska Governor Pete Ricketts. “These tests have helped provide over 350,000 test results to date, or about 40% of the state’s tests.”

A spokesperson for the governor of Iowa stated that its testing program using Co-Diagnostics’ tests “has greatly expanded testing in the state of Iowa.”

A spokesperson for the Utah Department of Health said that the state now uses a different company to provide testing services, and “does not have any formal relationship with Co-Diagnostics.” He did not elaborate on why the state changed testing providers.

The company is now promoting a new “ABC” test, which combines tests for influenza A and B with a test for the coronavirus. On Nov. 23, CEO Dwight Egan told Bloomberg that there was “very strong demand” for the company’s tests around the world.

But even as he projected confidence in the company’s future, that same day, he sold more than 70,000 shares of stock in his company, worth more than $700,000. Days later, Chief Financial Officer Reed Benson sold all of his company stock. As of Nov. 25, both Egan and Benson hold no direct stock in the company.

Co-Diagnostics did not respond to NPR’s questions about those stock sales.